During a practical lesson on November 15, 2023 on the discipline “European Approaches to Identifying and Eliminating Cyber Threats in the Financial Sector”, implemented within the framework of the international research grant “EU Practice to Protect the Financial System from Cyber Threats” (grant agreement No. 101085364 – EU_PITCH), students of the KS-21 group majoring in Software Engineering were involved in the webinar “Latest Trends in Banking Fraud & Cybercrime Prevention”.

The speaker was Cédric Fresard, Senior Risk Consultant at NetGuardians. NetGuardians is an award-winning Swiss financial technology organization that helps financial institutions in more than 30 countries fight fraud. More than 100 banks and wealth managers, including 40 percent of all Swiss state-owned commercial banks and three of the top 10 private banks according to Euromoney, rely on NetGuardians’ AI solutions to prevent fraudulent payments in real time.

The speaker emphasized that the key trends in cybercrime and fraudulent schemes in the banking system are:

- social engineering (phishing, searching for passwords and proprietary information to hack a computer system in the garbage thrown out of the organization – dumpster diving)

- virus software

- external theft

- theft of bank cards

- use of counterfeit cards copied from real cards

- purse theft

- card skimming

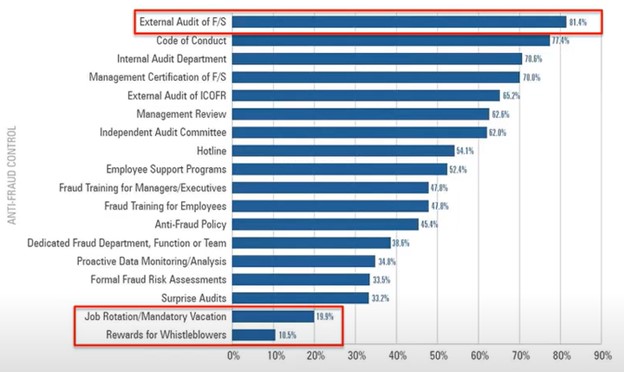

The emphasis in terms of cybersecurity measures for banking customers was placed on the insertion of keyloggers and replacement of SIM cards for using mobile banking services. For employees, analysts, and bank management, the speaker highlighted a number of the most common fraud protection measures (Fig. 1).

In addition, as part of the workshop, students analyzed in mini-groups the EU legal framework for preventing and combating fraud in electronic banking, in particular the Payment Services Directive (PSD2), the General Data Protection Regulation, and conducted a study of security measures used in the EU to minimize fraud in electronic banking.